Background

This competition, "Optimal Tax Policy with Heterogeneous Agent Models," is one of the challenges hosted by AAMAS 2025. It focuses on designing optimal tax policies in an economy with heterogeneous agents. In real life, taxation and public spending are two key government policies that affect economic growth and wealth distribution. A good government needs to adjust tax and spending policies based on the needs of society to support economic development, social fairness, and long-term stability. However, people’s economic behaviors are different (heterogeneous), making tax policy design a complex challenge.

Behavior of Heterogeneous Agents

Traditional economic models assume that people are rational decision-makers who maximize their own benefits. However, in reality, people are different in many ways, including:

- Income levels: Some people earn high salaries, while others rely on investments or low-income jobs.

- Consumption and savings: Some people save money for the future, while others spend a lot and sometimes go into debt.

- Work preferences: Some work long hours to earn more, while others prefer a better work-life balance.

- Investment strategies: Some people choose safe investments, while others take high risks to try to earn more.

These different behaviors together shape the overall economy, affecting wealth distribution, economic growth, employment, and social welfare.

Challenges of Government Tax Policy

For a government, designing an optimal tax policy in a society with different types of people is a difficult task. The government must balance several goals, such as:

- Income redistribution: How can taxes be fair, so that the rich pay more while keeping the economy strong?

- Work incentives: How can taxes encourage people to work without making them avoid paying taxes?

- Public welfare: How should tax money be spent to benefit everyone?

- Long-term growth: How can tax policies support both short-term stability and long-term development?

To study these problems, we introduce the TaxAI Simulator, a simulated economy where different economic actors make decisions, interact, and adjust to changing conditions. This simulator allows us to test how AI can make smart decisions in a complex economic system.

TaxAI Simulator: Economic Roles

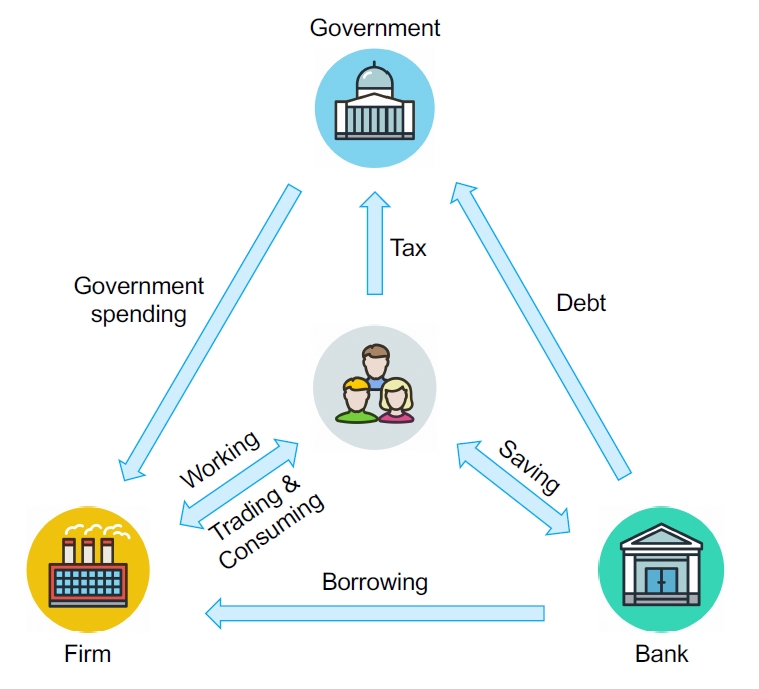

The TaxAI Simulator includes four key roles: government, households, companies, and financial institutions. The government and households make decisions that change over time, while companies and financial institutions follow fixed rules as part of the environment.

Households

- The simulator has multiple households, each making decisions independently.

- Households have different levels of productivity, which can change over time.

- They earn wages from companies (production), buy goods (consumption), and save money in financial institutions (investment).

- Households pay taxes to the government.

- Their well-being depends on balancing work and consumption:

- - Working too much reduces quality of life.

- - Higher consumption improves happiness.

Government

- The government controls tax policies and public spending to manage the economy.

- It collects taxes from households and borrows money from financial institutions.

- The government invests in companies to promote production and economic growth.

- Its goal is to increase GDP (economic output) and reduce wealth inequality.

Financial Institutions

- Financial institutions (such as banks) accept deposits from households and pay interest.

- They lend money to governments and companies.

Companies

- Companies hire workers and pay them wages.

- They sell goods to households.

- They receive investments from the government and loans from financial institutions.

For a detailed description of the relationship, see GitHub Link: github link 。