Background

The competition is sponsored by the China Computer Federation (CCF) and jointly organized by the CCF Computational Economics Professional Group and the Nanjing Institute of Artificial Intelligence Innovation of the Chinese Academy of Sciences. The title of this competition is Taxing AI.

In real life, taxation and public spending are two important policies related to socio-economic development and the gap between rich and poor. A reasonable government often needs to dynamically adjust these two policies according to the realities of the people. In reality, however, household people are often assumed to be independent and that each household pursues his or her own interests. People's day-to-day activities can be boiled down to production, consumption, investment, and exchange. Each household is paid for its work (production), which is used to buy goods (exchange) to meet the needs of life (consumption), and may deposit surplus funds in the bank or for financial management (investment). For each family, how to distribute income and how to balance work and rest time to improve life happiness, has been a long-term topic. Some families are thrifty and save for a long time for a rainy day. Some families prefer instant pleasures and often can't make ends meet. Some people choose to work long hours and work hard but neglect their health; Some people prefer to work from 9 to 5 and spend a lot of time enjoying life. The aggregate economic activities of these households constitute a macro economic society, and their evaluation will be reflected in indicators such as economic growth, wealth distribution and social welfare. For the government, how can it promote steady and sustained economic growth?How to ensure social fairness and stability and narrow the gap between the rich and the poor?How can every family live a happy life and enjoy social benefits? These have been long-standing goals and responsibilities of the government.

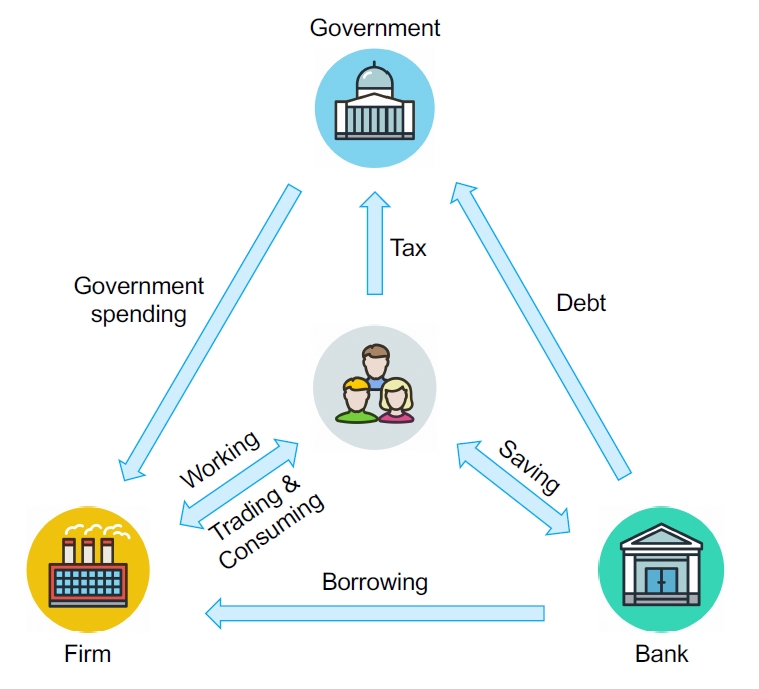

In order to explore the complex game problem described above, we construct a TaxAl simulator to explore the conflicts and connections between the decisions of different actors in an ideal environment, and how an agent can make rational decisions in complex situations. TaxAl simulator has four roles: government, households, companies and financial institutions (as shown in the figure above). In practice, firms and financial institutions are determined by predefined hyperparameters and fixed rules as part of the environmental mechanism, while government and households change dynamically due to different decisions. The direct relationship between each role can be summarized as:

- household: An household has multiple households, each acting as an independent household and maximizing their own personal interests. households' productivity levels are hierarchical and fluctuate over time. households can choose to receive remuneration from the company for a certain amount of time (controllable) and purchase goods or services from the company for a certain amount of money (controllable) for consumption. households can also choose to deposit the remaining funds in financial institutions and receive regular appreciation based on interest rates. households are also required to pay taxes to the government. The interests of each household will be determined by work and consumption, for example, working long hours to the detriment of personal interests and consumption will increase personal interests.

- Government: The government, acting as the center of economic regulation, borrows money from financial institutions and levies taxes on households, and the government invests the funds in companies (as government spending). The main objectives of the government are to promote domestic production and to balance the distribution of wealth in society.

- Financial institutions: Financial institutions, such as banks, receive deposits from households and pay interest at interest rates. Financial institutions will also lend to governments and companies.

- Company: A company pays households for their work and sells goods to them. The company will also receive investments from the government and loans from financial institutions.

For a detailed description of the relationship, see GitHub Link: github link 。